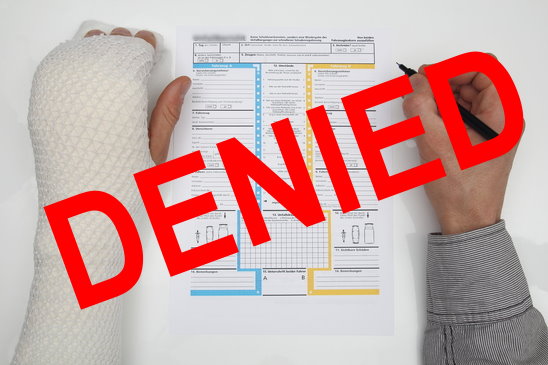

The Insurance Industry Does Not Care About You

July 18, 2019 | Accidents, Personal injury, Workers' compensation

The Insurance Industry Does Not Care About You…

The above statement is very likely true across the entire insurance spectrum, whether it be a health insurer doing their very best to deny you treatment that should be covered, an auto-insurer engaging in bad faith on personal injury settlements, or your homeowner’s policy premiums that you’ve paid for 20 years skyrocketing because you made one claim on your roof due to hail damage.

To understand why the insurance industry behaves the way that it does you need to know one thing: holding onto their money makes them money. Insurance companies collect millions upon millions of dollars in premiums every year, and due to the miracle of compound interest, the longer they hold onto that money the more money they make. Making money in that manner frequently comes at the expense of the policy holder or an injured party.

In a State like Nebraska, which is exceptionally friendly to insurance companies, an insurer is almost incentivized to jerk you around and engage in bad faith because the cost of doing so is relatively small.

For example: let us assume I sustain a workplace injury that is compensable under Nebraska Workers’ Compensation Laws. The insurance company that administers my employer’s policy continually ignores my policy, and in bad faith, wrongfully denies me coverage for my injuries.

Eventually I hire an attorney and the attorney is able to force the insurance company to pay for my medical treatment. Perhaps they even get attorneys’ fees and penalties under Chapter 48 due to the wrongful denial that amount to $10,000. The Insurer should feel chastened, as they have just been forced to pay $10,000 that they would not have otherwise had to pay if they had just administered my claim properly.

The insurer is not chastened: the entire industry is predicated on wrongfully denying claims and dragging these things out as long as possible because the money they are holding onto makes them more money in interest than they are penalized. This is why many states have created bad faith laws that apply to wrongfully denied workers’ compensation benefits – those bad faith lawsuits, where the damages awarded are not capped by workers’ compensation laws can see six and seven figure verdicts.

Those verdicts get the insurer’s attention, and thus the insurer in a bad faith state is incentivized to obey the law. But as I’ve noted, Nebraska is not a bad faith state. So what can you do to protect yourself?

The short answer is: if you feel you are being taken advantage of or given short shrift by an insurance company…lawyer up. That may seem self-serving from a law firm, but it’s very often the best way to make certain the insurance company fully compensates you for the harm you’ve suffered.

There are instances where hiring a lawyer may not add enough value to justify hiring a lawyer. The most obvious instances is when the insurance company has accepted your claim and you feel you’re being treated fairly, or already being compensated. The other instance is when your damages, the harm you’ve suffered, are so minimal that the insurance company’s initial offer is enough to properly compensate you. But even in those cases it can be beneficial to contact an attorney to inform you of your rights, and to make sure you understand the process moving forward.

High & Younes provides free consultations. Give us a call at (402) 933-3345.

Insurance claim denied